A Biased View of Kam Financial & Realty, Inc.

A Biased View of Kam Financial & Realty, Inc.

Blog Article

Some Ideas on Kam Financial & Realty, Inc. You Should Know

Table of ContentsThings about Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Can Be Fun For EveryoneThe Definitive Guide for Kam Financial & Realty, Inc.The Best Guide To Kam Financial & Realty, Inc.Rumored Buzz on Kam Financial & Realty, Inc.Some Known Details About Kam Financial & Realty, Inc.

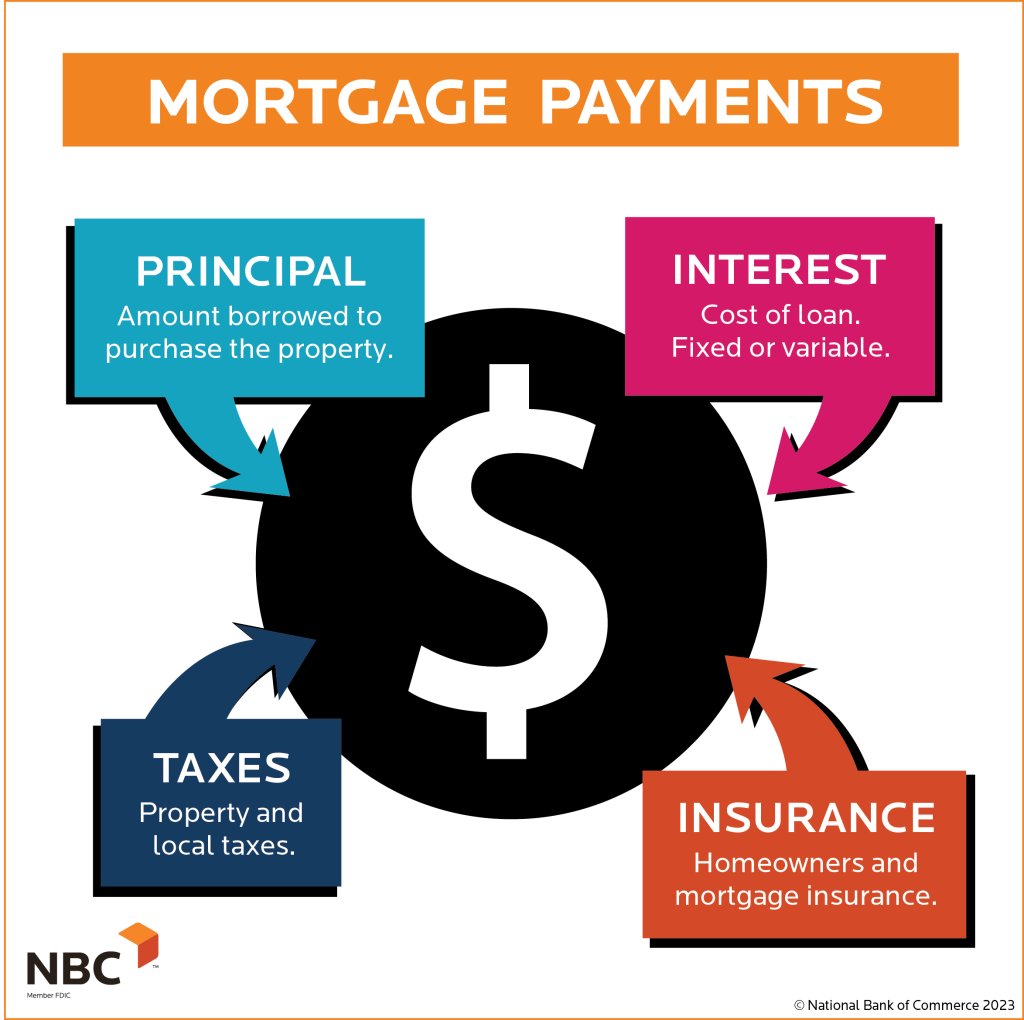

A home loan is a car loan utilized to acquire or keep a home, story of land, or other genuine estate. The consumer consents to pay the loan provider gradually, normally in a series of normal payments split right into major and rate of interest. The property after that acts as security to safeguard the loan.Home mortgage applications undertake a strenuous underwriting procedure prior to they get to the closing phase. Mortgage kinds, such as conventional or fixed-rate lendings, vary based on the debtor's requirements. Mortgages are fundings that are utilized to acquire homes and other kinds of realty. The home itself acts as collateral for the lending.

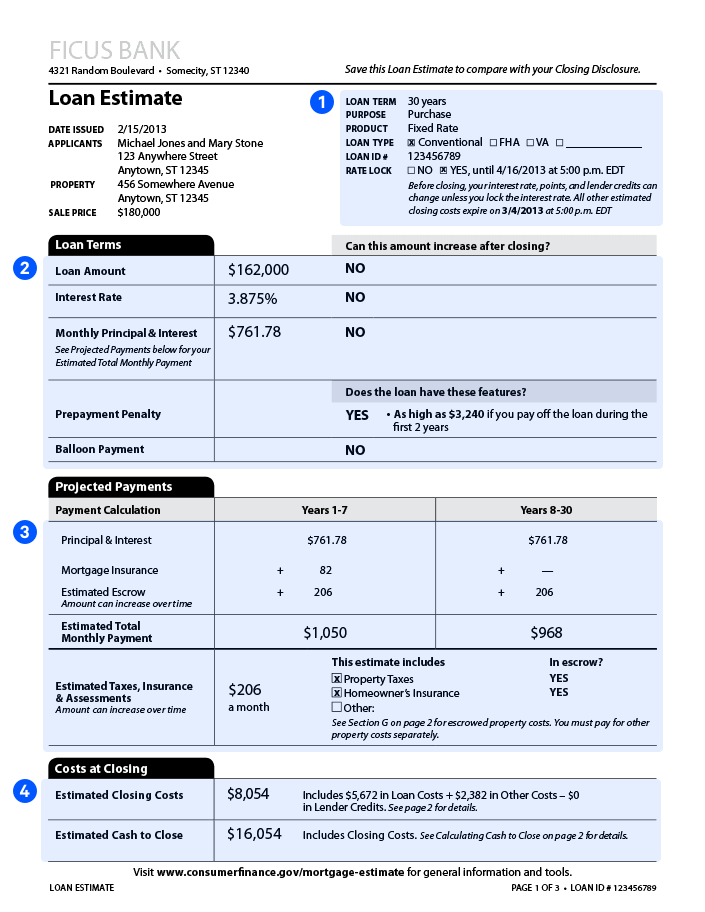

The expense of a home mortgage will depend on the type of car loan, the term (such as 30 years), and the interest rate that the lender fees. Home loan prices can vary widely depending on the kind of item and the credentials of the applicant. Zoe Hansen/ Investopedia People and services use home mortgages to get realty without paying the whole acquisition price upfront.

The 4-Minute Rule for Kam Financial & Realty, Inc.

Many typical home loans are completely amortized. Regular home loan terms are for 15 or 30 years.

A property buyer pledges their residence to their lender, which after that has a case on the residential or commercial property. In the situation of foreclosure, the loan provider may force out the citizens, offer the residential property, and use the money from the sale to pay off the mortgage financial debt.

The lending institution will ask for evidence that the consumer is qualified of settling the lending. https://www.wattpad.com/user/kamfnnclr1ty., and evidence of current work. If the application is accepted, the lender will offer the consumer a lending of up to a particular quantity and at a specific interest price.

An Unbiased View of Kam Financial & Realty, Inc.

Being pre-approved for a mortgage can offer purchasers a side in a limited real estate market due to the fact that sellers will certainly understand that they have the cash to support their offer. As soon as a purchaser and vendor concur on the terms of their offer, they or their representatives will fulfill at what's called a closing.

The seller will certainly move possession of the residential property to the purchaser and get the agreed-upon amount of money, and the buyer will authorize any kind of continuing to be mortgage files. The lender might charge costs for coming from the finance (often in the kind of factors) at the closing. There are thousands of choices on where you can obtain a home mortgage.

Kam Financial & Realty, Inc. - Truths

:max_bytes(150000):strip_icc()/standing-mortgage.asp_Final-f243f07e8a22431ba1a4c32616f127a2.jpg)

The basic kind of home mortgage is fixed-rate. A fixed-rate home mortgage is likewise called a standard home loan.

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

The entire funding equilibrium comes to be due when the borrower dies, moves away permanently, or sells the home. Factors are essentially a cost that consumers pay up front to have a lower passion rate over the life of their funding.

Everything about Kam Financial & Realty, Inc.

Just how a lot you'll need to spend for a home loan relies on the type (such as dealt with or adjustable), its term (such as 20 or 30 years), any kind of discount points paid, and the rate of interest at the time. mortgage lenders california. Rates of interest can differ from week to week and from lender to lending institution, so it pays to shop around

If you default and seize on your home loan, nonetheless, the financial institution may come to be the new proprietor of your home. The rate of a home is usually far more than the quantity of cash that most homes conserve. Consequently, home loans permit people and households to acquire a home by taking down just a reasonably small down settlement, such as 20% of the acquisition price, and obtaining a lending for the balance.

Report this page